February 8, 2026 [crocon media – msc] In the frothy days of 2020-2021, Special Purpose Acquisition Companies (SPACs) were the Wild West of Wall Street, hyped deals that often left everyday investors nursing losses amid overvaluations and redemption rushes. Fast-forward to today, and the landscape has matured. Post-bust reforms have tightened structures, with enhanced investor protections like extended redemption rights, performance-linked incentives for sponsors, and more rigorous due diligence baked into deals. These evolutions mean lower risk premiums, fairer pricing, and a focus on fundamentals over frenzy.

February 8, 2026 [crocon media – msc] In the frothy days of 2020-2021, Special Purpose Acquisition Companies (SPACs) were the Wild West of Wall Street, hyped deals that often left everyday investors nursing losses amid overvaluations and redemption rushes. Fast-forward to today, and the landscape has matured. Post-bust reforms have tightened structures, with enhanced investor protections like extended redemption rights, performance-linked incentives for sponsors, and more rigorous due diligence baked into deals. These evolutions mean lower risk premiums, fairer pricing, and a focus on fundamentals over frenzy.

Enter Infleqtion’s pending merger with Churchill Capital Corp X $CCCX, a prime example of this refined approach. Valued at a pre-money equity of $1.8 billion, the deal promises over $540 million in gross proceeds (assuming no redemptions), blending a hefty $416 million trust account with a $125 million-plus PIPE from blue-chip backers like Maverick Capital $AXVEF and Morgan Stanley’s Counterpoint Global. For individual investors, this isn’t just another blank-check bet… it’s a gateway to quantum tech at a stage where revenue traction and strategic partnerships outweigh speculative hype.

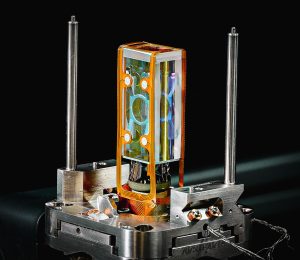

Infleqtion $INFQ, the Boulder-based powerhouse formerly known as ColdQuanta, stands out as a commercial frontrunner in neutral-atom quantum technology, a modality prized for its scalability, flexibility, and cost-efficiency. Unlike the pie-in-the-sky promises of early SPAC darlings, Infleqtion is already monetizing its innovations. As of mid-2025, the company boasted trailing twelve-month revenue of approximately $29 million, with $50 million in booked and awarded contracts signaling multi-year growth potential.

Its pipeline? A robust $300 million-plus, fueled by deployments in quantum computing and precision sensing for high-stakes clients like the U.S. Department of Defense, NASA, and global enterprises.

Its pipeline? A robust $300 million-plus, fueled by deployments in quantum computing and precision sensing for high-stakes clients like the U.S. Department of Defense, NASA, and global enterprises.

This isn’t vaporware, Infleqtion’s Sqale quantum computer is live at the UK’s National Quantum Computing Centre, and it’s the sole foreign participant in Japan’s Quantum Moonshot program. Add in a fresh $100 million Series C round from June 2025, led by Glynn Capital, Counterpoint Global, S32, and SAIC, and you have a well-capitalized entity primed for scale.

What elevates Infleqtion beyond typical SPAC fare is its alignment with surging industry tailwinds. Quantum tech isn’t niche anymore. Allied governments have poured over $40 billion into the space for geopolitical edge, emphasizing national security applications like advanced sensing and unbreakable encryption.

Infleqtion’s neutral-atom systems excel here, operating at room temperature (a boon over cryogenic rivals) and delivering orders-of-magnitude improvements in computing power and precision timing.

Recent partnerships underscore this momentum: a collaboration with French aerospace giant Safran $SAFRY / $SAFRF validates its quantum sensors for defense-grade navigation, while ties with Silicon Light Machines aim to turbocharge quantum computer performance via MEMS tech integration. Then there’s the $50 million public-private push in Illinois to build a utility-scale quantum system targeting 100 logical qubits, positioning Infleqtion at the vanguard of error-corrected, practical quantum platforms.

The broader quantum ecosystem is heating up, too, with heavyweights like Nvidia $NVDA bridging classical and quantum worlds. Nvidia’s CUDA-Q platform, an open-source powerhouse for hybrid quantum-GPU supercomputing, enables seamless integration of quantum processors with AI-accelerated hardware.

This isn’t coincidental. Infleqtion counts Nvidia among its trusted partners, tapping into CUDA-Q for simulations and workflows that could unlock breakthroughs in drug discovery, materials science, and financial modeling.

As Nvidia invests in quantum startups and deploys NVQLink for scalable error correction, the synergy amplifies Infleqtion’s edge, think quantum-enhanced AI tackling problems classical chips can’t touch. With quantum computing projected to disrupt trillion-dollar markets, Infleqtion’s merger arrives at an inflection point: post-NISQ era, where utility-scale systems shift from lab curiosities to commercial realities.

As Nvidia invests in quantum startups and deploys NVQLink for scalable error correction, the synergy amplifies Infleqtion’s edge, think quantum-enhanced AI tackling problems classical chips can’t touch. With quantum computing projected to disrupt trillion-dollar markets, Infleqtion’s merger arrives at an inflection point: post-NISQ era, where utility-scale systems shift from lab curiosities to commercial realities.

For retail investors, this SPAC’s maturity shines through. Unlike the 2020-2021 wave, where over 800 deals flooded the market amid zero-interest euphoria (leading to median returns of -89% for de-SPAC stocks by 2024), today’s setups prioritize alignment. Infleqtion’s all-stock structure at $10 per share, coupled with a fairness opinion and pro forma majority ownership for existing holders, minimizes dilution risks.

The deal’s timeline, filing in January 2026, effectiveness by late January, and expected close February 13, reflects streamlined execution in a post-boom regulatory environment. Add Nasdaq-to-NYSE migration under ticker INFQ, and it’s a polished path to liquidity without the volatility pitfalls of yesteryear.

Yet, amid the positives, context matters. Quantum remains an emerging field, with execution risks tied to tech scalability and market adoption.

Infleqtion’s strong balance sheet (zero debt, ample liquidity) buffers near-term burns, but broader economic headwinds could sway redemptions.

Follow us on X : https://x.com/CroConMedia/status/2020410659058450639

Editorial Disclosure: The editorial content on this page is not provided by any entity mentioned herein. Opinions expressed here are the author’s alone, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Disclaimer: The author(s) of this article may or may not hold a position in the mentioned stock. None of the companies discussed in the above article have paid for this content. The information provided in this article should not be considered financial advice, and readers should always do their own research before making investment decisions. However, as with any investment, there are potential risks and uncertainties to consider, such as potential regulatory changes, market volatility, and competition from other players in the industry. It is important for investors to carefully monitor this stock and its performance over time to make informed decisions about their investments. crocon media is a project of The SiLLC Assembly. This site is for entertainment purposes only. The owner of this site is not an investment advisor, financial planner, nor legal or tax professional and articles here are of an opinion and general nature and should not be relied upon for individual circumstances. This article is for informational purposes only and should not be considered financial advice. Investing in stocks involves risk, and readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.